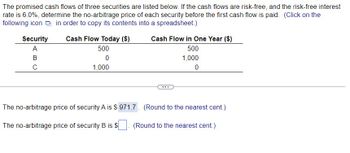

On the existence of a perfect market with no arbitrage that contains a forward contract - Quantitative Finance Stack Exchange

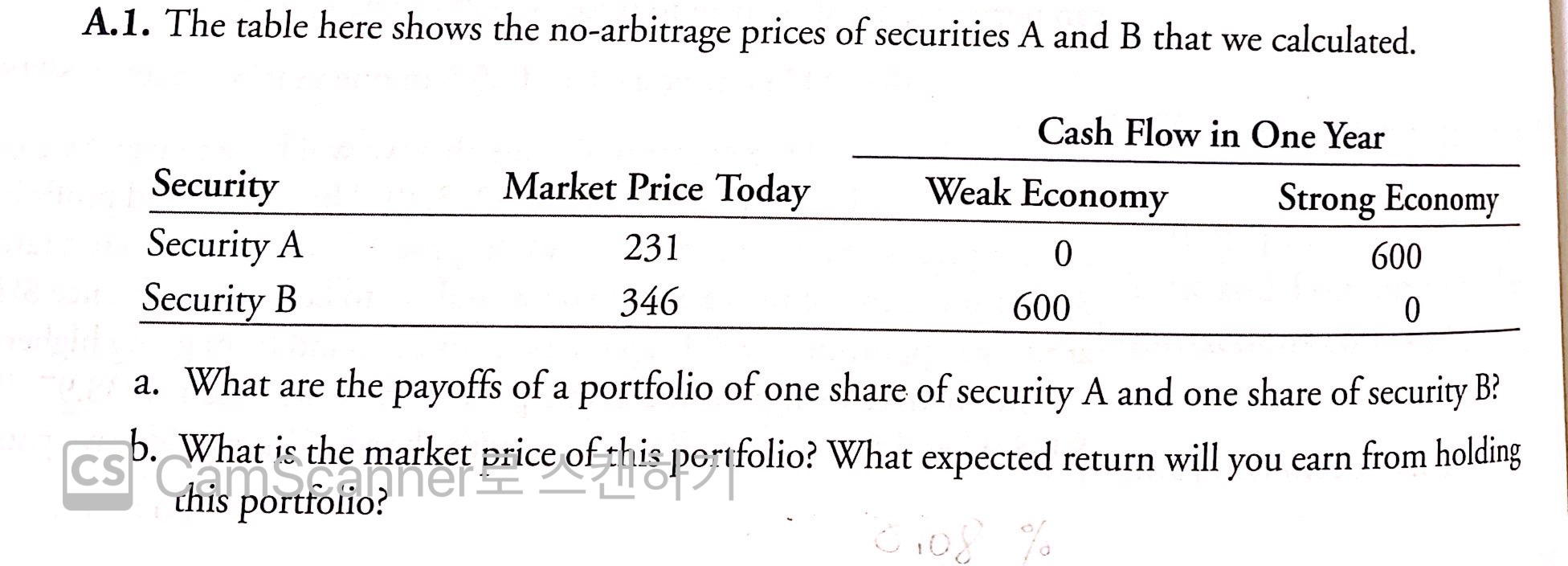

No-arbitrage conditions and expected returns when assets have different β's in up and down markets | SpringerLink

Arbitrage free implies complete market in general binomial model? - Quantitative Finance Stack Exchange

International Finance FINA 5331 Lecture 14: Covered interest rate parity Read: Chapter 6 Aaron Smallwood Ph.D. - ppt download